Source: Banks to shell out US$700m on NRZ – The Zimbabwe Independent October 5, 2018

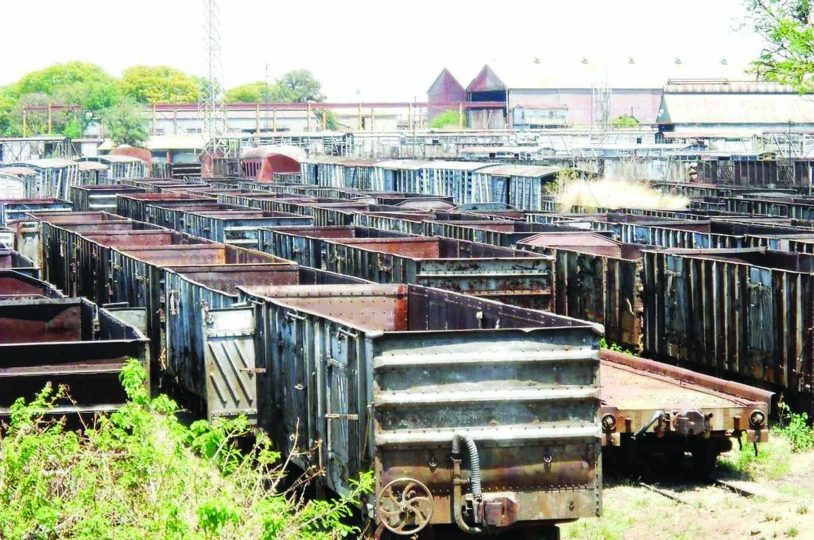

NRZ wagons

LEADING South African banks and Zimbabwe’s biggest bank by asset base — CBZ — as well as a pan-African financial institution are ready to fund the US$400 million National Railways of Zimbabwe (NRZ) recapitalisation project as they have now provided term sheets securing at least US$700 million for the rehabilitation of the country’s vast but dilapidated railway network, it has been established.

BY TINASHE KAIRIZA

The availability of funds comes as the parties involved in the project — the NRZ, South African rail, port and pipeline company, Transnet, and Diaspora Infrastructure Development Group (DIDG) — met on Monday in Harare to assess progress in seeking approvals, drafting agreements and the implementation of the project amid growing demands for urgency in execution. The meeting, held under the auspices of Zimbabwe’s Ministry of Transport, was attended by officials from the NRZ, Transnet, DIDG, Office of the President and Cabinet, Reserve Bank of Zimbabwe (RBZ), the State Enterprises Restructuring Agency and ministries of finance, defence and transport. Lawyers and accountancy firms that are transaction advisers and consultants also attended.

Transport minister Joel Biggie Matiza confirmed the meeting yesterday, saying it was meant to establish “progress realised so far”.

“Presentations were made. By February (next year) all the loose ends will be tied up,” Matiza said.

“South African banks (working with the DIDG consortium which is spearheading capital mobilisation efforts) have committed to avail the US$400 million needed to finance the deal. More money will be coming.”

Informed sources said banks which this week provided term sheets — bullet-point documents outlining the material terms and conditions of a business agreement — include Standard Bank that is ready to shell out between US$100 million and US$317 million; Absa (US$200 million), Nedbank (US$200 million); Industrial Development Corporation of South Africa (IDC) (US$100); Ecobank Kenya (US$100 million) and CBZ (US$50 million).

There are also other development finance institutions in South Africa and pan-African banks still working on their offers.

In the end, between US$700 million and US$1 billion could be secured before evaluation of the financiers to appoint the mandated lead arranger or debt book-runner, a source said.

In investment banking, a book-runner is the main underwriter or lead coordinator in equity, debt, or hybrid securities issuances. The book-runner syndicates loans with other investment banks in order to lower exposure or risk.

DIDG, which is run by a group of Zimbabweans in South Africa and a network of other diaspora-based locals with the main objective of raising funds to invest in various sectors of the economy, mainly critical economic infrastructure, is playing the leading role in capital mobilisation for the project.

DIDG chairman Donovan Chimhandamba yesterday confirmed that funding has now been secured.

“I can confirm that we have now received term sheets from Standard Bank which has agreed to provide between US$100 million and US$317 million; Absa about US$200 million, Nedbank US$200 million and IDC (US$100 million). We also have on board Ecobank which will, through their Nairobi office, provide US$100 million and CBZ with US$50 million to cover the local component of the funding.

“Foreign banks will use their offshore balance sheets to participate in the transaction, while local banks, CBZ in this case, and local subsidiaries of foreign banks, for instance, Stanbic and Nedbank in Zimbabwe, may also fund the local component of the deal.

“It is critical that we ensure foreign debt or loans are not unnecessarily extended to fund local transactions. This will ensure participation of both local and foreign banks.”

The NRZ recapitalisation deal is structured as a project finance arrangement, a long-term financing of infrastructure and industrial projects based on projected cash flows of the venture rather than the balance sheets of its sponsors.

This means there is no sovereign guarantee required from the government and no down payment. The NRZ will get up to 5% of the revenues, starting with US$8 million and this will increase up to US$20 million a year. The money will allow the NRZ to refinance and settle its US$350 million legacy debt.

After receiving the term sheets, DIDG—whose role is to arrange funding for the project in which a total of US$406 million is required with the deal’s peak finance expected to rise to US$602 million — will then sit down with Transnet, whose exposure is about 7,5% or US$30 million, and the NRZ, among other stakeholders like the Ministry of Finance and RBZ, to go through the funding agreements’ terms and conditions to ensure the best deal and structure.

“The parties, with DIDG as the lead capital-raising partner, will come up with a work stream; tasks to be done by different groups within the consortium required to finish the project. Then a mandated lead arranger or book-runner will be appointed to run with the transaction. This will be part of the job which will have to be done in the next 100 days as part of cabinet’s 100-day work cycles,” a source who attended the meeting said.

Another source said one of the critical areas which need to be addressed urgently is ensuring that Transnet secured all relevant approvals as soon as possible to allow lawyers to finish drafting necessary agreements and transaction advisers to conclude their duties before the deal is closed.

In terms of the agreement and structure of the deal, the NRZ — which requires US$1,7 billion to comprehensively overhaul and modernise its rail infrastructure — is the contracting authority. DIDG-Transnet Joint Venture 1 is expected to arrange funding and Transnet is responsible for manufacturing and supplying locomotives as well as the provision of technical and operations expertise. There is also a Joint Venture 2 to be operated by Joint Venture 1 (DIDG-Transnet) and the NRZ which will be responsible for railway operations in Zimbabwe.

NRZ public relations manager Nyasha Maravanyika yesterday also confirmed the meeting, but would not divulge details.

“Negotiations are still ongoing. In terms of progress we can’t be preemptive. Negotiations are still ongoing, before the end of the year we would have finalised the discussions,” Maravanyika said.

The project has already been unfolding with the provision of an interim rolling stock solution which comprises 14 new-age locomotives, 200 high-side wagons and seven passenger coaches. The solution structure entails full lease of rolling stock at below market cost, leveraging existing interchange agreement between Transnet and the NRZ, and provision of spares, support and maintenance for leased fleet.

As a result, this has increased passenger and freight volumes where interim solution rolling stock is operating and improved the NRZ revenues resulting in the struggling rail utility moving from paying 50% of employees’ salaries to pay around 90% levels.

The interim measures also include the rehabilitation of railway sleepers locally. The NRZ requires 200 000 sleepers annually to meet regular track maintenance requirements.

Due to interim measures, the NRZ will resume placing sleeper orders with Fort Concrete. The envisaged US$10 million recapitalisation of Fort Concrete in a joint venture deal between Aveng Infraset of South Africa and DIDG will speed up the revival of the NRZ whose rail network covers 3 077 kilometres.

In the 1990s, the NRZ used to transport over 14 million tonnes with peak traffic scaling 18 million tonnes per year in 1995. However, the dramatic decline of Zimbabwe’s economy over the past two decades hit the NRZ hard and left it reeling, only able to move 2,7 million tonnes a year.

Newer Post

Zim runs out of health drugs Older Post

NSSA pardons defaulting employers

COMMENTS

CBZ is an insolvent bank – how can it do this ?