Source: ECONOMIC TALK: The hidden crisis in business today | The Financial Gazette March 8, 2018

THE transitional government is under immense political pressure to prove it can perform the heroic act of delivering recovery now or make way for new thinking.

What many people don’t want to hear at this juncture are stories of a recovery that will come in the distant future, on some date not found on the calendar.

But going through the state of the economy at macro and firm levels, I haven’t found any basis for hope, not even the flimsiest reason for optimism.

This paper extends the analysis of Zimbabwe’s solvency crisis from government to the private sector and reaches the conclusion that both have limited capacity to lead the economy to recovery owing to a crippling solvency crisis.

The analysis of corporate financial distress is based on both balance sheet indicators and qualitative variables.

The rate of corporate failure in Zimbabwe has risen precipitously since dollarisation in February 2009 while corporate financial distress is at the highest level since the end of hyperinflation in late 2008.

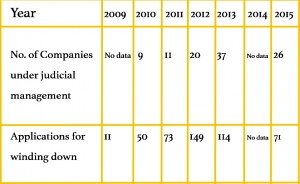

From just 11 in 2009, the number of insolvency cases filed at the High Court soared every year in the first four years of dollarisation and peaked at 169 in 2012.

Cumulatively, the company failure tally hit 474 by 2013. By the end of 2015, the number of insolvency cases was rapidly approaching 1 000.

Every year since 2009, there have been more petitions for liquidations than for rehabilitation (judicial administration), reflecting limited availability of long-term finance from banks, equity markets and bond markets to save promising businesses in financial distress. Another emerging pattern of note is that the bulk of the High Court applications for winding down resulted in actual liquidation, indicating a negative survival rate.

Over the period 2009-2014, only 10 companies survived liquidation through judicial administration while the rest went under. The list of liquidations includes five entities which were listed on the Zimbabwe Stock Exchange (ZSE).

The manufacturing sector has had the highest number of companies in liquidation and under judicial management relative to other sectors.

The gravity of Zimbabwe’s corporate solvency crisis was corroborated by the World Bank/IFC in the 2015 Doing Business Report, which asserted that “considering the current market of Zimbabwe, the most likely (solvency) proceeding would be liquidation” as opposed to reorganisation.

Since the report was released, Zimbabwe’s liquidity crisis has intensified while financing options have not improved, exposing more companies to distress risk and dragging those already in distress into bankruptcy.

Some firms which had good turnaround and viability prospects if restructured were liquidated after judicial managers failed to secure fresh capital.

Bank loan books have remained lean while the ZSE has progressively thinned out in liquidity.

What started off as a liquidity crisis has aggravated to a corporate solvency crisis whose roots can be traced back to dollarisation.

Although dollarisation had the immediate effect of ending hyperinflation and stabilising the economy, it almost immediately led to the evaporation of all forms of liquidity—cash flow liquidity, funding liquidity and market liquidity (with respect to financial instruments) — largely because it was introduced with too many atypical improvisations which aggravated the strain of hyperinflation.

What made the economic implosion severe was that dollarisation was launched officially, but implemented informally. The stock of local currency in circulation — bank balances and cash at hand — was not converted into hard currency, literally writing off every Zimbabwe dollar balance sheet in the economy.

All of a sudden, everyone — from government, corporates to households — had to scrabble everywhere for US dollar cash to survive the liquidity shock.

No wonder, many businesses ironically endured Zimbabwe’s gravest economic crisis in history for a whole decade (1998-2008) only to stumble and fall in the aftermath, with limited resource to bank and non-bank funding.

Whereas hyperinflation left businesses in a weaker financial position, dollarisation consequently drove them into financial distress, which plunged others into bankruptcy. Government’s failure to convert Zimbabwe dollar cash balances to hard currencies practically wiped out working capital and forced companies into a state of start-up, having to rebuild balance sheets in hard currency within a context of depressed sales and high cost of funding.

In 2009, the Confederation of Zimbabwe Industries estimated that the manufacturing industry required about US$2 billion to recapitalise (both opex and capex), a figure that was more than double the country’s total banking sector deposit base of about US$706 million at the end of September that year.

The Chamber of Mines of Zimbabwe also reported around the same time that the mining industry required as much as US$5 billion to recapitalise over five years.

Bunched together, the mining and manufacturing industries alone required nearly US$10 billion to recapitalise. If all sectors of the economy were to be included, the total recovery capital bill would probably be four-fold.

Five years later, the findings of the inaugural State of the Mining Industry Survey launched and conducted by Nu Times Innovations in 2015 established that the funding liquidity crisis in the mining industry had worsened.

At national level, the US dollar liquidity situation has remained tight as foreign direct investment underperformed, leaving the economy to depend on exports and diaspora remittances.

With lean US dollar reserves and no lender-of-last-resort facility, the Reserve Bank of Zimbabwe (RBZ) could do little to intervene in financial markets and ameliorate the liquidity impact of dollarisation. In fact, central bank liquidity was one of the key policy challenges that had to be addressed in the early years of dollarisation as well.

In these financial upheavals, Zimbabwean banks had to stampede into offshore wholesale markets for funding, first to recapitalise up to minimum capital levels required by the RBZ, and secondly, to resume their core business of lending since their base of US dollar deposits was still low. The total banking sector deposit base was only US$1,36 billion at the end of 2009 from US$400 million at the end of March, two months into dollarisation.

What kept Zimbabwe’s banking sector going until late 2013 was wholesale market funding from Afreximbank, Trade and Development Bank and other development finance institutions which provided credit at rates as high as 10-15 percent per annum on account of Zimbabwe’s high country risk.

Reflecting these trends, local credit was dominated by off-balance sheet lending and short-term facilities with a tenor of under 24 months and interest rates of up to 40 percent per annum, reflecting the high cost of funding from the wholesale market. Accordingly, in the first seven years of dollarisation, banks had to survive precariously on fees and commissions and very little interest income.

Since the default solution to financial distress at firm level was to acquire debt, a large number of companies ended up over-extending their balance sheets in the hope that adjustments to the underlying business model could turn fortunes around and offset the effect of unfavourable lending terms.

In cases where the underlying business did not pick up after leveraged recapitalisation, the exposure to debt further propelled the financial distress from funding liquidity crisis to the current corporate solvency crisis.

Because of constrained domestic credit supply, limited external lines of credit and high interest rates on available credit facilities, it took just about a year for the liquidity crisis to aggravate to a solvency crisis.

By 2010, just a year into dollarisation, up to 70 companies had approached the High Court citing debt distress, particularly unsustainable interest costs on short-term debts.

The steepest rise in company failures observed in 2012 reflected the impact of early borrowings — short-term working capital facilities of less than 24 months in tenor, at punitive interests rates.

High debt servicing costs deprived businesses of working capital, which forced some companies into rights issues or new debt to retire or roll over high-interest short-term obligations.

African Sun, for instance, had to borrow from Afreximbank to meet local debt obligations. At least half of ZSE rights issue transactions effected between 2009 and 2015 were primarily aimed at substituting short-term bank debt with equity finance as a way to fight debt distress.

A majority of insolvency cases filed at the High Court were “non-payment” or “missed payment” defaults involving companies that failed to meet debt servicing and interest payments to financiers when they fell due. Only a few cases were bank insolvencies caused by failure to meet minimum capital requirements.

Invariably, missed payment defaults originated from high interest costs on short-term loans acquired soon after dollarisation to fund capital investment and working capital needs, resulting in a greater proportion of gross operating earnings being channelled to loan servicing costs, squeezing the bottom-line and triggering defaults and insolvencies.

Rather than mitigating or resolving the dollar liquidity crisis, short-term debt only created a much graver crisis — a solvency crisis. In other words, liquidity-induced debt has acted as a conduit through which the funding liquidity crisis translated to a solvency crisis. High leverage became the confluence where the liquidity and solvency crises met.

The blowbacks of high interest costs also hit back at banks as Non-performing Loans (NPLs) ballooned to unsustainable levels. The ratio of NPLs to total loans hit a post-hyperinflation peak of 20,4 percent at the end of June 2015 from under 10 percent in 2009, putting banks at risk of liquidity and solvency crises.

The Reserve Bank of Zimbabwe has had to create the Zimbabwe Asset Management Company to take over NPLs and save banks, which were at the risk of a liquidity and solvency crisis.

Since 2014, the number of solvency petitions at the High Court has fallen. However, the downtrend is more of a fall in solvency proceeding acceleration than an improvement in the solvency profile of Zimbabwean businesses.

It can be proved that solvency proceedings have shifted from court enforcement to voluntary arrangements, since the first wave of bankruptcies accelerated by banks died out.

As a result, companies struggling to meet their current obligations or generate positive operating income from the underlying business have continued to operate as going concerns.

In response to the liquidity crunch of dollarisation, companies have taken all sorts of measures to retain cash and preserve themselves as going concerns: laying off workers; down-scaling shifts and closing down some plants; disposing of non-core divisions, slashing marketing budgets and selling off some assets.

Still, signs of financial distress are ubiquitous across all sectors of the economy.

For example, a majority of corporate accounts held by ZESA, city councils, the Zimbabwe Revenue Authority and TelOne have more than 90 creditor days, a clear sign of financial distress or possible insolvency.

An increasing number of trading companies have put off insolvency by negotiating payment plans on legally enforceable debt or agreeing other debt roll-over arrangements, most of which are not formally agreed.

If all businesses were to be subjected to a cash flow insolvency test, very few would remain standing.

By and large, payment plans and debt tolerance have largely absorbed much of the debt that should have sparked insolvency proceedings.

Just think of how many of your clients have missed their payment schedules or have had to negotiate payment plans to avert legal proceedings. If you care to investigate, you will find out that they too are waiting for one or more of their clients who are also waiting for their own clients to pay.

It’s a vicious cycle of cash flow insolvency, a self-sustaining corporate debt spiral which only a few businesses have managed to handle sustainably.

Many companies are now in the habit of settling claims only when stern payment demands have been made, usually involving threats of enforcement proceedings. More often than not, companies have too many pressing obligations at the same time which cannot all be met at one blow.

Naturally, the most demanding creditors, especially those that have secured payment plans, get paid first while the rest are pushed further down in the payment schedule.

Many companies in this position have continued to trade with impaired cash flows, under growing financial distress and at the risk of insolvency, in the hope that business prospects would improve some time “soon”.

Generally, Zimbabwean entrepreneurs have developed an unnatural resilience in the face of crisis, which has helped to reduce their susceptibility to voluntary liquidations. After enduring 10 years of economic turmoil, they feel that they have already seen the worst and just won’t give in.

In a way, businesses are now given to debt tolerance, an evolving way of coping with insolvency collectively, which has helped to hold down the solvency crisis in a steady-state. Businesses recognise pretty well that their struggling clients are only victims of an economy-wide problem for which someone else, not necessarily themselves, is to blame.

Lastly, cash flow challenges have generally come to be accepted as a “new normal”, something that businesses have to take and live with. Thus, some businesses have continued to trade fully aware that they are approaching the point of no return; that point when all the means to meet both current liabilities and prospective ones within a reasonable time are completely eroded.

Businesses have somehow realised that the consequences of taking formal solvency proceedings against their clients would be far more costly than letting sleeping dogs lie given the prevalence of defaults, for that would mean taking nearly all of their clients to court. In fact, a large number of businesses are trapped in the insolvency cycle mainly because of high customer concentration, a problem created by years of economic contraction. More often than not, the biggest sales orders come from the very clients with overdue accounts. Yet, when the economy finally turns in the future, they will need the same debtor clients to sustain their businesses.

As a result, company voluntary arrangements, especially negotiated payment plans, have become the most common proceeding of enforcing overdue claims. Such semi-formal debt roll-overs are mutually beneficial in that the debtor is relieved of financial distress while the supplier’s cash flows are redeemed, putting them in a better position to resume supplying goods and services.

However, negotiated survival strategies and delayed insolvency proceedings without viable turnaround plans will only pause rather than stop the clock from ticking towards the hour of reckoning.

Business prospects are unlikely to improve any time soon, given the current state of the economy. Chances of returning to profitability keep diminishing as the crisis intensifies.

For instance, aggregate domestic demand remains depressed by tight liquidity conditions, low consumption spending, low investment, constrained profit margins and negative sales growth.

Against this backdrop, what is likely to increase is the risk that the corporate debt crisis will spread into the remaining pockets of viable businesses. Depending on the strength of economic linkages and supply chains, the failure of one business may bring five others down.

At this juncture, any further increase in economic strain would claim another group of casualties among those operating under financial distress or exposed to high distress risk. Unless foreign investment rules change to allow foreign companies to buy distressed debt in exchange for control, every insolvent company may be shoved across the red line, straight into liquidation given Zimbabwe’s poor survival rate.

Munyaradzi Mugowo is an economist, researcher and consultant on mineral economics, industrial policy, development economics and social policy. He is the managing consultant of Ziopra Consulting P/L and can be reached at munya.mugowo@gmail.com.

COMMENTS

What would Zanu know about an inclusive wealth generating programme? The Zanu model is to beat, rape, loot and murder their way in a terrorist modus operandi to achieve power. Zanu are Selous Scouts – simple.

The ex Top Selous Scout has gone to South Africa to find a way to get his power back again because he does not want to lose his 21 farms. On top if that he employed ex Seous Scouts to manage the farms when he was busy telling the people not to employ white farmers? What do we really think that ED will do?