Source: Zimbabwe Devaluation Sees Return of Market Sense, But Only Some – Bloomberg

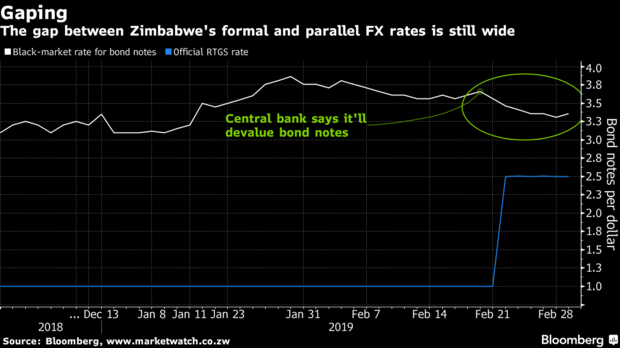

- Quasi currencies have fallen to 2.5 to the dollar in past week

- Central bank ended dollar parity for the currencies on Feb. 20

Zimbabwe’s currency devaluation last week has led to a more realistic exchange rate, yet thin trading implies the new official interbank market isn’t as free as officials suggested.

The central bank announced on Feb. 20 that its quasi-currencies — bond notes and their electronic equivalent — would no longer be valued at parity to the dollar and would be traded on an official interbank market.

Since then, the bond notes, now known as RTGS dollars, have weakened to 2.5 against the greenback, while the black market rate has appreciated almost 9 percent to 3.36 per dollar, according to marketwatch.co.zw, a website run by financial analysts in Harare. The tight trading band on the interbank market — rates have ranged between 2.5001 to 2.5042 this week — indicates trading isn’t totally free. The RBZ seems to be the only supplier of dollars, with just $7.7 million traded as of Thursday, a person familiar with the matter said.

There’s also been some improvement, again modest, with equities.

The dollar squeeze roiled the stock market, with locals piling into it to hedge against inflation, which is officially 57 percent but may be as high as 270 percent, according to Steve H. Hanke, a professor of applied economics at Johns Hopkins University in Baltimore. That caused foreign investors such as Cape Town-based Allan Gray Ltd. — which struggle to get their money out of the country because of capital controls — to write down their holdings to more realistic levels. They measure how out of whack prices are by taking the difference between the Harare and London shares of Old Mutual Ltd., Africa’s largest insurer.

The Harare stock has sunk 18 percent this week to $7.50, which in Zimbabwe’s skewed markets is a sign that the liquidity crisis is easing. It’s now 4.5 times the price of that in London, when converted to dollars, down from 6.3 in January.

Investors won’t be confident the foreign-exchange crisis is over until Zimbabwe’s formal and informal currency rates and the so-called Old Mutual implied rate all converge.

COMMENTS

Congratulations to the Nutty Professor Mthuli, ED and Strive for stealing the Peoples’ Cows and giving the pictures of little cows – 2.5 times smaller than the ones they were entrusted with by the people. In the broader world this is called a Ponzi Scheme. The really smart part about the pictures of little cows that have been exchanged for real cows – is that these fine gentlemen above Mthuli, ED and Strive have managed to convince some of the people for some of the time! – but not all of the people for all of the time! The Ponzi Scheme is a Zanu Masterpiece – and a new version of the greatest Zanu Ponzi Artists/Heroes of Yesteryear – Sir Robert Gabriel Ponzi Mugabe and Dr. Gideon Ponzi Gonzo who were truly in a league of their own in their time – billions of per cent inflation. There is one artist overlooking all these great works not quite sure where to fit in perhaps – Eddie Ponzi Cross?